Ginkgo REIT

Investment Summary

-

- Current Net Asset Value per Share: $136. Next Closing scheduled for March 1, 2026.

- Focused on Workforce Housing: Targets multifamily properties in the Southeast, especially for the rental workforce

- Value-Add Strategy: Enhance properties through renovations to boost rents and resident retention.

- Proven Management Team: Experienced in real estate with over 9,000 units acquired and strong track record of returns.

Overview

Ginkgo REIT, Inc. (“GREIT,” the “REIT,” or the “Fund”) is focused on purchasing, upgrading, and managing apartment communities that target the rental workforce (jobs found in government, retail, entry level, lower to middle management). The Fund is focused on the growth markets of the southeast and anticipates the purchase or contribution of many of the existing assets currently managed by Ginkgo Residential for partnerships that have completed renovation plans, increased rents, and are seeking to retain ownership of stabilized properties.

Business Plan

GREIT seeks to produce long-term, stable returns through the ownership of a portfolio of multifamily communities.

This Fund aims to invest in existing multifamily communities, typically constructed before the 2000s. These well-maintained properties offer opportunities for significant value-add and renovations. Enhancing cash flows is a priority, achieved through improvements to interiors, exteriors, and infrastructure. Such improvements decrease operating costs and utility expenses paid by residents, extend the economic and useful life of the communities, improve resident retention, and generate rent growth.

The Fund seeks to maintain a debt leverage of less than 70% of the fair market value (FMV) of the REIT’s assets. This approach provides the potential for enhanced dividend benefits to shareholders and mitigates risk during adverse operating conditions.

About the Manager

Ginkgo Residential LLC externally manages the REIT. Through separate contracts, it acts as the REIT’s Advisor and also serves as the property manager for each of its communities.

The Ginkgo Residential management team has a proven record of providing safe, affordable housing and delivering returns to investors. From 1997 to 2007, the Advisor, formerly known as BNP Residential Properties, Inc., achieved a 394% return for investors, compared to the S&P 500’s 286%, making it the second-best performing multifamily company during its public listing. In 2010, the team shifted focus to acquiring and upgrading older properties through “value-add” workforce housing projects. From March 2011 to June 2024, Ginkgo acquired over 9,000 apartments in North Carolina, South Carolina, and Virginia, with more than 4,392 units fully recapitalized or contributed to Ginkgo REIT.

Ginkgo REIT is structured as an umbrella partnership, with Ginkgo Multifamily OP LP serving as the REIT’s operating subsidiary (“UPREIT”). While the REIT primarily seeks cash investors through share sales, it can also raise capital by accepting property contributions to the operating partnership in exchange for operating partnership units issued to sellers instead of cash.

Over 35% of the REIT’s total equity, amounting to $75 million, is held by employees, their family members, and Board members.

Ginkgo REIT is audited by Grant Thorton LLP.

Financials

GREIT’s hybrid investment model includes owning communities through both wholly owned and joint venture agreements. Joint ventures allow shareholders to participate in outsized returns through our General Partnership (GP) position when certain investment thresholds are achieved.

Ginkgo REIT maintains a strong balance sheet with 60% LTV and less than 5% of debt maturing in 2024. Anticipating rising rates in 2020 and 2021, management locked in low rates on nearly all consolidated assets, protecting against rising debt costs and achieving balance sheet gains.

Consolidated assets have 100% fixed-rate mortgage-backed financing with a 5.7-year average maturity and a 4.4% average interest rate.

Historically, the REIT used variable-rate mortgages for unconsolidated joint ventures. In 2023, it refinanced $87 million of floating-rate debt (18% of the total) to fixed-rate, reducing average interest from over 7.5% to 5.65%. As of June 2024, approximately 73% of this debt is variable-rate, down from 98% at the end of 2022, with rate caps or swaps in place at 0.75%-4.55%.

Market Overview & Opportunity

Ginkgo REIT owns and manages 1% of the total housing supply in the Carolinas, amounting to 6,535 units, and is actively expanding its footprint.

-

- Location: North Carolina has become a top destination for people relocating from other parts of the country thanks to its major cities, temperate weather, elite educational institutions, and easy access to beaches and mountains. Over the past decade, more than one million people have moved to the state. Ranked America’s Top State for Business in CNBC’s 2022 and 2023 studies, North Carolina boasts a robust economy and growing companies, attracting workers nationwide. South Carolina’s GDP is approximately $300 billion, ranking 26th in the U.S. Major industries include aerospace, automotive, and advanced manufacturing. The state has a population of over 5 million residents, growing at a rate of 1.3% per year.

-

- Homeownership: Purchasing a house is becoming increasingly difficult due to rising interest rates and property values. The average 30-year fixed mortgage rate has increased to around 7% mid 2024 from about 3% in early 2021. Median home prices have surged over 30% in three years, reaching over $400,000. Despite a 10% rise in household incomes, they haven’t kept pace with home prices and interest rates, leading to a drop in the Housing Affordability Index. Consequently, down payments and monthly mortgage payments have nearly doubled, making it harder for households to afford homes.

-

- Multifamily Debt Maturities: Multifamily sales volume reached all-time highs in 2021 and 2022 (with North and South Carolina Multifamily volume reaching $38Bn in the two years combined), with many firms acquiring assets at low cap rates using short-term debt at low interest rates. As short-term interest rates have continued to rise, heavily leveraged multifamily syndicators are struggling with higher interest payments that their assets cannot cover. The high level of debt is not easily replaceable, and anticipate some forced selling to occur starting in the late first and early second quarter of 2024.

Capital Investment Strategy

After the acquisition, the Ginkgo team prioritizes enhancements to the community, emphasizing ESG-oriented improvements. These upgrades encompass everything from curb appeal to interior walls and common areas. Ginkgo invests in water management, exterior finishes, deferred maintenance correction, energy conservation, and upgrades to common areas, including amenities and clubhouses.

As a vertically integrated platform, Ginkgo provides in-house property, asset, and construction management, which gives it a significant operational advantage.

-

- Rent: Over the past three years, same-community rent per occupied unit has grown by an average of 9% per year. Rent growth in Q1 2024 began to stabilize, with signed renewal offers averaging 4%, compared to 12% in Q1 2023. New lease trade-outs averaged 7% increases, driven by renovation premiums. Collections showed a slight improvement in Q1 2024, at 96.7%, compared to the previous quarter.

-

- Occupancy: Occupancy averaged 92.2% during Q1 2024 compared to 92.7% a year earlier. New apartment supply is rippling through the market in Charlotte and the Triangle. In the Triad, single family homes are being converted to rentals, which are competing directly.

-

- Capital Expenditures: In Q1 2024, $6.7 million was spent on non-recurring capex across all REIT operating communities. A large portion of the spend was allocated to 141 unit improvements, resulting in an approximately 10% average return on cost.

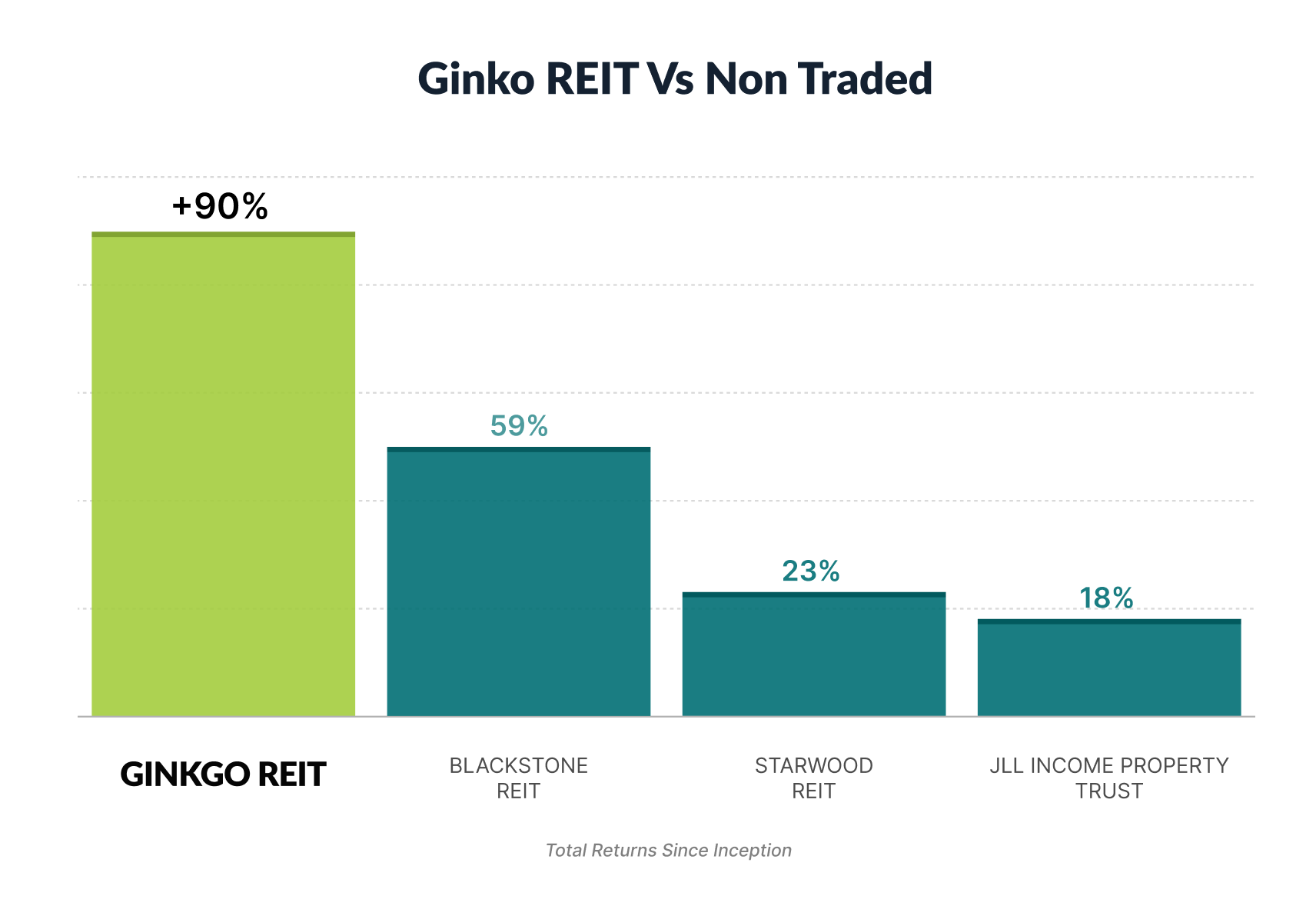

Historical Performance

Since inception (July 2019) through May 31, 2024, our REIT investors’ average annual return and total return have been 13.7% and 85.5%, respectively.

The REIT’s dividend has increased 26% since inception and is $0.63 monthly (5.36% annualized). Depreciation benefits provide a current tax-equivalent dividend yield of 9.20%.

*Inception date July 2019 through April 2024.

It’s important to note that past performance is not indicative of future results.

Liquidity & Fees

| Advisor Fees | |

| Capital Raising: | 0% commission* |

| Asset Management: | 1.25% of NAV |

| Property Management: | 4.5% of collections |

| Construction Management: | 6% of the capital plan |

| Acquisition & Disposition Fee: | 1% of purchase/sale price |

| Performance Incentive | |

| Performance Allocation: | 20% of Hurdle Rate excess paid to Advisor |

| Hurdle Rate: | Re-set annually at 10-yr Treasury Rate plus 3%; any prior years’ missed Hurdle Rate added. Minimum Rate is set at 5%. |

Redemptions are limited and subject to a declining discount during the first 5 years of an investor’s holding period.

Dividend Reinvestment is optional, but mandatory for capital accounts less than $100,000.

* The REIT may, in its sole discretion, choose to pay a placement fee to approved and accepted third party equity providers. Refer to Offering Memorandum for additional information.

Documents

Investor Packet:

Supplemental Offering Materials:

- Ginkgo REIT – 2025 Semi Annual Report

- Ginkgo REIT – 2024 Annual Report

- Ginkgo REIT – Q1 2025 Update

- Ginkgo REIT – 2 Page Overview

- Ginkgo REIT – 2023 Booklet

- Ginkgo REIT – Warrants Offering Presentation

- Ginkgo REIT – 2023 Annual Report

- Ginkgo REIT – 2023 Semi Annual Report

- Ginkgo REIT – 2022 Annual Report

- Ginkgo REIT – Dividend Reinvestment Program