Elevate your portfolio beyond stocks and bonds

REAL ESTATE INVESTING

▪ Start with our REIT Fund with as little as $25,000

▪ An innovative way to invest in quality real estate

in a durable asset class across the fastest growing MSAs in the U.S.

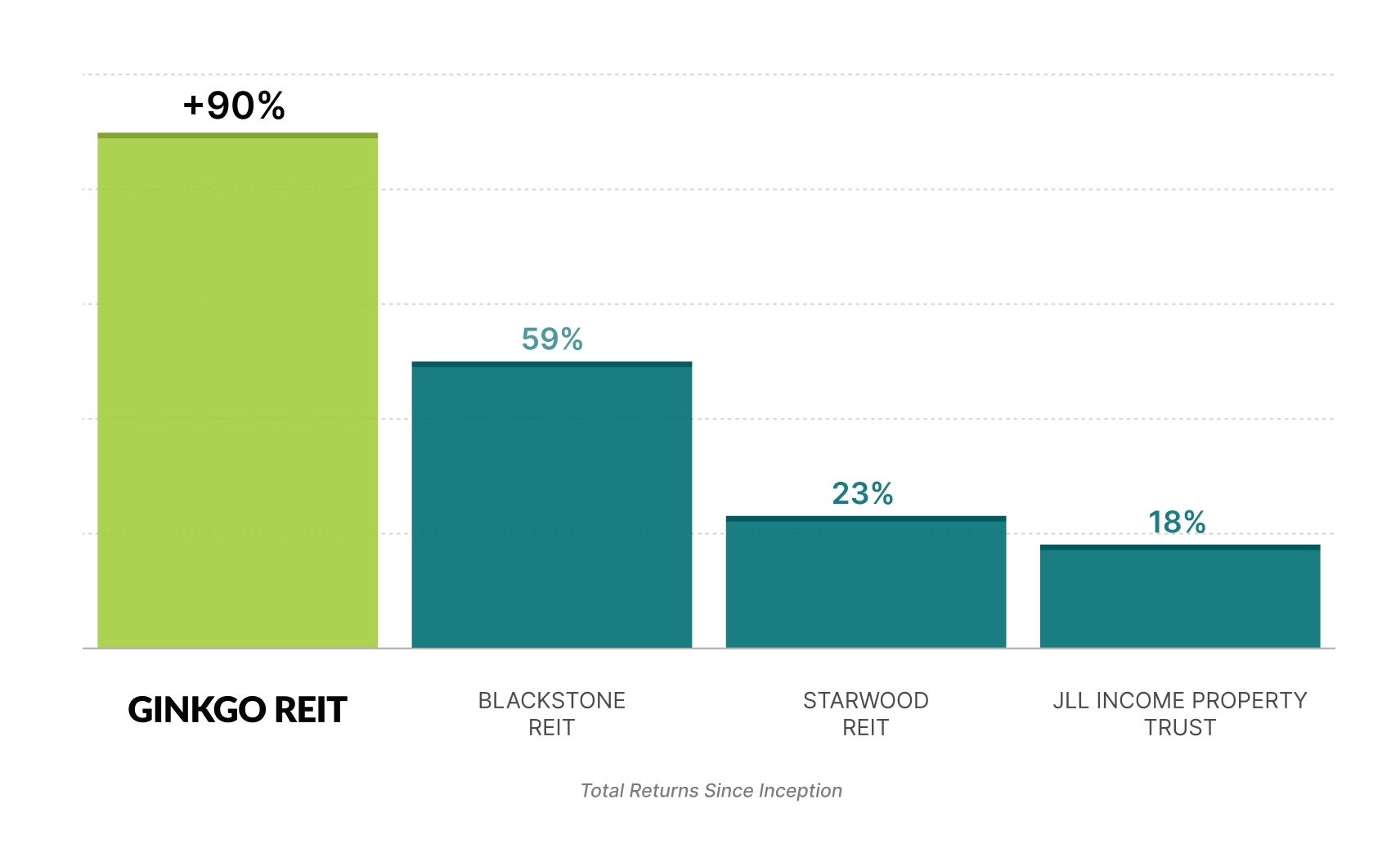

Ginkgo Reit vs. Non-traded REIT Total Return Inception-To-Date

Proven Management Team

A legacy business operating for over 35 years, in private and public markets

Focused Business Model

A pure play on workforce residential rental housing in two of the most dynamic population growth states – North & South Carolina

Aligned Interest

The executive officers, employees and members of the board have a significant co-investment in the portfolio

Invest with GINKGO through Notes, Funds,

Individual Assets, or Tax-Advantaged Investments

Notes offer a CD alternative with flexible terms to support working capital needs.

-

Offering term options of 1, 6, 12 and 24 months

-

Option to rollover principal into future Notes offerings

-

Short term holds

Investing in Ginkgo REIT offer a simple way to add a commercial real estate portfolio with built-in diversification compared to individual assets.

-

Faster diversification

-

Lower investment threshold

-

Focused investment thesis – geographic region and investment strategy

-

Potential for liquidity through redemption

-

Monthly Dividend

Curate your commercial real estate portfolio online with a few clicks. Add individual investments that are right for you.

-

Self direct your investment deal by deal

-

No crowdfunding or placement agent intermediary

-

Potential for depreciation pass-through to LPs

The 721 Exchange, or UPREIT, allows an exchange of ownership in a single asset into an operating partnership (OP) that owns multiple assets.

-

Defer capital gains income tax. Step up basis at death could eliminate income tax to heirs

-

Diversification

-

OP equity interest can be sold at any increment and tax is pro-rated for each OP unit sold

-

Monthly Dividend